Life Insurance Within Your Superannuation Fund

It is estimated that 95% of Australians don’t have enough life insurance. An analysis of life insurance needs conducted by Rice Walker

Actuaries calculated that a mid-30s couple with young children would need 10 to 13 times their taxable income to provide adequate life

insurance cover. For a full time employee earning $60,000 per annum this equates to between $600,000 and $780,000 in cover. Full time

workers in their 40s with older children need six to nine times their taxable earnings while the industry average for superannuation

benefits is only around $70,000.

It is estimated that 95% of Australians don’t have enough life insurance. An analysis of life insurance needs conducted by Rice Walker

Actuaries calculated that a mid-30s couple with young children would need 10 to 13 times their taxable income to provide adequate life

insurance cover. For a full time employee earning $60,000 per annum this equates to between $600,000 and $780,000 in cover. Full time

workers in their 40s with older children need six to nine times their taxable earnings while the industry average for superannuation

benefits is only around $70,000.

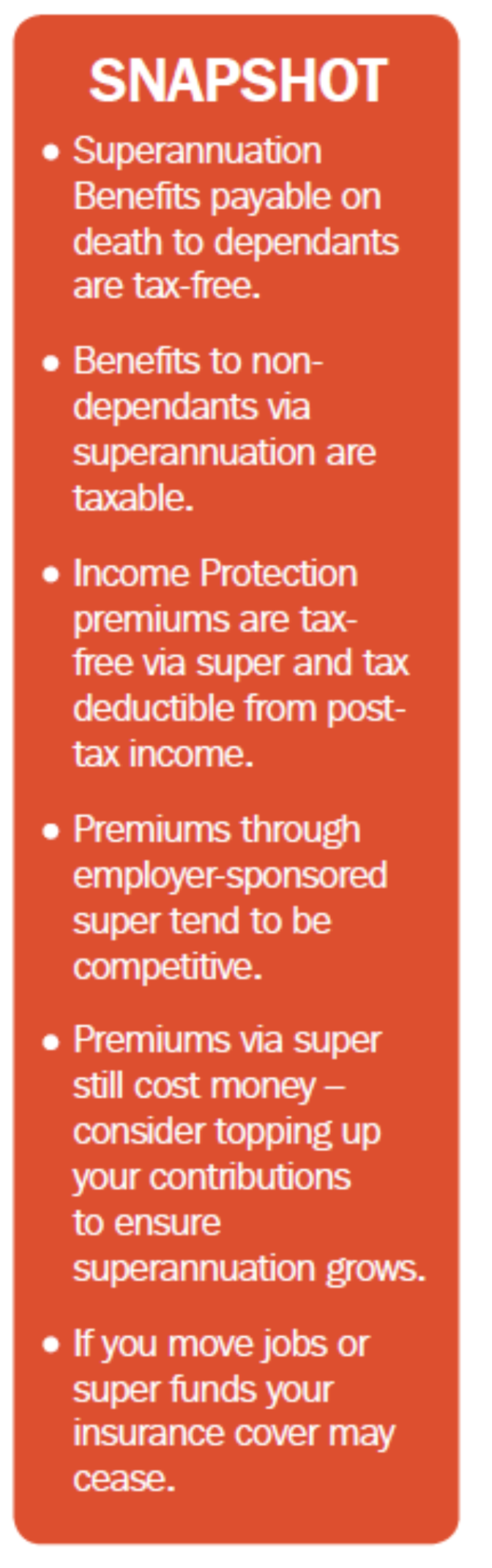

To bridge the insurance gap you can take out a separate policy to increase your life insurance cover or you can consider increasing your life insurance cover within your superannuation fund. Below we have outlined some of the pros and cons of increasing your life insurance cover through your superannuation, however, please seek professional advice before taking action.

ADVANTAGES

ADVANTAGES

- Competitive premiums because of the bulk buying power of funds.

- Set and forget – it is easy to set up and premiums are automatically deducted.

- Automatic acceptance – some funds won’t require a medical examination for basic cover.

- Super policies often include total and permanent disablement (TPD) and Income Protection.

- Premium payments via super funds may be more tax effective since the premiums are paid out of contributions made by your employer or from personal contributions that generate either a direct tax deduction (for the self-employed) or are paid from pre-tax income, in the case of salary sacrifice contributions.

- Cashflow advantages – you can elect to have premiums deducted from account balances rather than increasing super contributions to cover the premium.

- Subject to eligibility, you can elect to use after-tax contributions to pay your insurance premium within the fund and still claim a Government co-contribution.

DISADVANTAGES

- The level of cover within the superannuation fund may be limited or inadequate.

- Trauma insurance is not available through your fund.

- Premiums paid from superannuation contributions mean less money available to invest.

- Most income protection policies inside superannuation provide for only 2 years’ worth of income protection.

- You have to be severely disabled to get a payment for Total and Permanent Disability (TPD) and there are potential tax implications on TPD benefits depending on the age of the recipient.

- If you have more than one superannuation fund you may be paying for insurance in each fund.

- There can be delays in life insurance benefits being paid since these initially go to the fund, which then distributes them to the beneficiaries. Normally benefits are paid to dependents but the trustee is not required to take your wishes into account unless you have the option of making a binding beneficiary nomination.

- You should seek financial advice regarding tax implications where your beneficiary is not your financial dependent as they will be liable to pay tax on the amount. The same benefit paid from a policy held outside super is tax-free no matter who receives it.

Having some life insurance through your superannuation is better than not having anything at all. However, it is important to ask about the details of your superannuation fund and to know exactly what your insurance will or won’t pay and in what circumstances. You may find you need a combination of cover both through your superannuation and independently if that is going to better meet your needs.

Other articles in this edition:

- The 7 Website Essentials

- How Does Your Website Rank?

- Accounting Software - Another Brick In Your Business Wall

- Business Start Up Corner - What Is Your Cash Clock?

- Book Corner - Good To Great

- Marketing Corner - Email Marketing That Works

- Tech Corner - Voicemail For Your Website & Customised Email Signatures

- Self Managed Super Funds - Property Investments Yes or No?