Looking For A Comfortable Or Modest Retirement?

Australia’s superannuation system is the fourth largest in the world and continues to grow. The total assets held in Australian superannuation accounts is currently worth 100% of annual GDP and Deloitte reports that by 2033 it will grow to 180% of GDP. This is an extraordinary savings pool for a country with historically low savings rates.

The latest Deloitte report, released in September this year, provides a snapshot of our superannuation system and the key points include:

Most people do not have enough super

Most Australians nearing retirement will simply not have enough superannuation. A lot of the baby boomer generation only received superannuation support for the latter half of their working lives and according to the Association of Superannuation Funds of Australia (ASFA), the average 60-64 year old male has $85,000 in superannuation assets. Women of the same age who on average live longer, statistically earn less and may be out of the workforce for chunks of their working lives, on average have just $59,000 in superannuation assets.

For those slightly older (the 65-69 year olds) some of whom have already retired, the figures are even lower. Men in that age group have, on average, $77,000 in superannuation assets while women have just $55,000. They, like around 81% of current retirees, will have to rely (at least partially) on the aged pension.

Gen Y has a Super Outlook

Younger Australians who’ve worked most of their life with their employer paying money into superannuation will find they will be in much better retirement shape compared to the baby-boomers. For example, a 30 year old currently earning an average wage of $60,000 a year with a current superannuation balance of $27,000 will retire with approximately $1.1 million in superannuation in 2048. Although this figure sounds impressive, inflation means this amount will be enough to support that individual until they’re 94, but only on a ‘modest’ retirement. Modest is defined as ‘better than the age pension, but still only able to afford fairly basic activities’.

If this worker chooses a ‘comfortable’ retirement, the $1.1 million will only last them until they’re 77. A comfortable retirement lifestyle is defined as ‘enabling an older, healthy retiree to be involved in a broad range of leisure and recreational activities and to have a good standard of living through the purchase of such things as household goods, private health insurance, a reasonable car, good clothes, a range of electronic equipment and domestic and occasional international holiday travel’.

How much Superannuation do you need to Retire Comfortably?

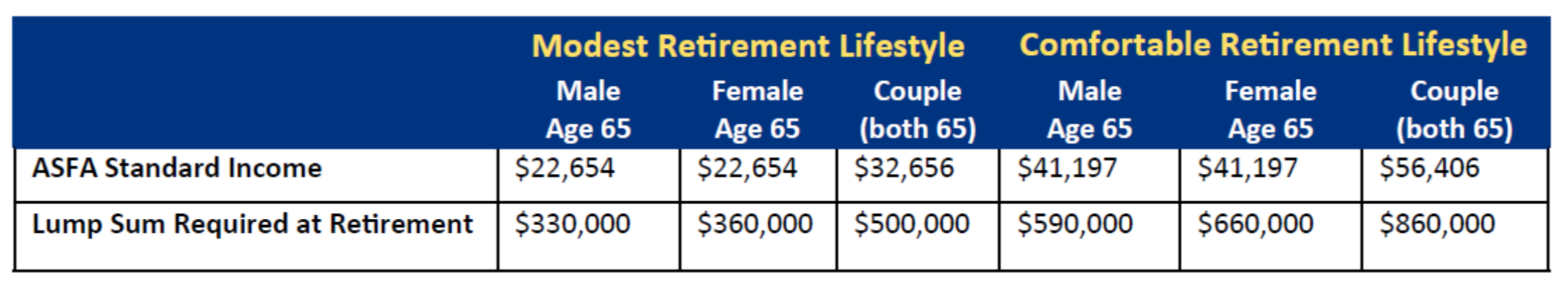

The ASFA calculates a retirement standard each quarter based on a ‘Modest vs Comfortable’ retirement lifestyle. Using current life expectancy rates, Deloitte has calculated how much super you need to retire with a ‘modest’ lifestyle or ‘comfortable’ lifestyle:

Superannuation hasn’t recovered from the GFC

The financial crisis, which began in 2009, had a huge impact on Australia’s superannuation assets and Deloitte sees the superannuation asset pool remaining below GFC levels until 2016. This highlights how much of a setback it was to the balances of millions of Australians, particularly those in retirement, or about to retire.

The compulsory SG contributions are the basis of the Australian superannuation system and the projected growth will make it one of the leading systems in the world. It is predicted that while the overall level of superannuation assets will grow significantly, adequate retirement funding and longevity risk will remain concerns for both the Government and individuals. Australians can take steps to improve their position by increasing contributions or delaying retirement. The age pension is then the safety net that applies when superannuation money dries up.

Other articles in this edition:

- Thinking Of Buying A Business in 2014?

- Prepare Your Business For Christmas

- Thinking Of Buying A Car Or Equipment In December?

- Labor Legislation Overturned By New Government

- Six Reasons Your Website Will Fail

- Business Start Up Corner - What You Really Need To Know About Your Business Name

- Is Running A Small Business Tougher Than 5 Years Ago?

- There's An App For That!

- Christmas Reading

IMPORTANT DISCLAIMER:This newsletter is issued as a guide to clients and for their private information. This newsletter does not constitute advice. Clients should not act solely on the basis of the material contained in this newsletter. Items herein are general comments only and do not convey advice per se. Also changes in legislation may occur quickly. We therefore recommend that our formal advice be sought before acting in any of these areas.