Increasing The Small Business Income Tax Offset

From 1 July 2016, the government will increase the current 5% tax discount (referred to as the SBITO) to 8%. The discount in tax payable is

currently available to an individual in receipt of income from an unincorporated small business entity (basically an entity with an

aggregated turnover of less than $2 million) and applies to the income tax payable on the business income received from such an entity.

The turnover threshold for access to the unincorporated small business income tax offset for individuals will increase from $2m to $5m and

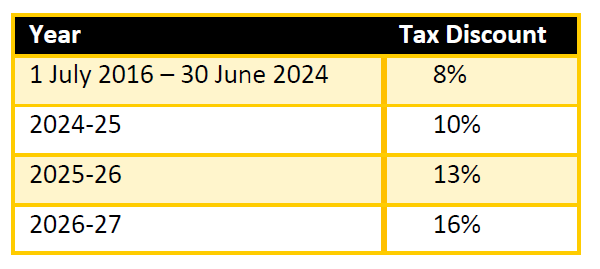

the discount will remain constant at 8% for eight years and will then increase to 10% in 2024/25, 13% in 2025/26 and 16% from 2026/27.

The current tax discount cap of $1,000 per individual for each income year will remain unchanged.

Click HERE to download the full edition of The Business Accelerator Magazine for June 2016

Other articles in this edition:

- 2016 Federal Budget Highlights

- Personal Taxation

- Reductions In Corporate Tax Rate

- Access To Small Business Tax Concessions

- Superannuation Changes

- Medicare Levy Low Income Thresholds for 2015/16

- Applying GST To Low Value Imported Goods

- Amendments To Division 7A

- Youth Employment Package - Bonuses For Hiring Young People & Interns

- SuperStream Deadline - 30th June

- Claiming Work Related Travel Expenses

- What Are The Acres Of Diamonds In Your Business?

- Starting A Business - Do The Numbers Stack Up?

IMPORTANT DISCLAIMER:This newsletter is issued as a guide to clients and for their private information. This newsletter does not constitute advice. Clients should not act solely on the basis of the material contained in this newsletter. Items herein are general comments only and do not convey advice per se. Also changes in legislation may occur quickly. We therefore recommend that our formal advice be sought before acting in any of these areas.