Personal Taxation 2013

Individual Tax Rates

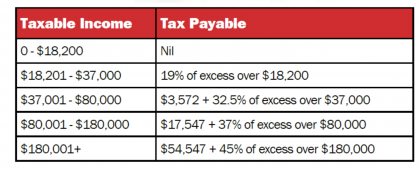

There will be no change in the marginal tax rates already legislated for individuals for the 2013, 2014 and 2015 income tax years. The Government has also indefinitely deferred the previously proposed increase in the tax-free threshold to $19,400 from 1 July 2015. The tax rates for resident individuals for the 2013 to 2015 income years (excluding the Medicare levy) will remain as follows:

Medicare Levy

Funding for the National Disability Insurance Scheme (Disability Care) was confirmed in the Federal Budget and will be funded by an increase of 0.5 percent in the Medicare levy (to 2 percent) from 1 July 2014.

The Medicare Levy low income thresholds for the 2012/13 income year will increase to $20,542 for individuals, $32,279 for pensioners eligible for the Seniors and Pensioners Tax Offset and $33,693 for families. The additional family threshold amount for each independent child or student increases to $3,094.

Net Medical Expenses Tax Offset

The Net Medical Expenses Tax Offset (NMETO) will be phased out from 1 July 2013 through a combination of reducing the range of medical expenses that qualify for the offset and limiting the number of taxpayers who qualify for the offset. Individuals will only be able to claim the NMETO in the 2014 and 2015 income tax years if they claimed the offset in the prior year. From 1 July 2015, the NMETO will be restricted to out of pocket medical expenses relating to disability aids, attendant care and aged care expenses. The NMETO will be removed from 1 July 2019 when Disability Care Australia will be fully operational.

In the 2013 income tax year, individuals can claim a tax offset of 20% of all net medical expenses over $2,120.

Self-Education Expenses

Work related self education expense deductions will be capped at $2,000 from 1 July 2014. Previously there was no cap. The proposal will limit the amount that individuals can claim for self education expenses incurred in undertaking a course or activities that have a direct connection to their current work activities. Accordingly, expenditure on course and tuition fees, textbooks, journals, computers, stationery and travel and accommodation costs will be limited from 1 July 2014.

Employers who provide or fund work related education and training for employees will not be liable for fringe benefits tax regardless of the amount unless the employee salary sacrifices to obtain these benefits.

The existing discounts which apply to up-front and voluntary payments made under the Higher Education Loan Program (HELP) will be removed from 1 January 2014.

Baby Bonus Abolished and ‘Work Test’ under the Paid Parental Leave Scheme Extended

The Baby Bonus will be abolished from March 1, 2014 in favour of new support for families of newborns through the Family Tax Benefit Part A (FTB Part A). The Government will increase these payments by $2,000, to be paid in the year following the birth or adoption of a first child or each child in multiple births, and $1,000 for second or subsequent children. The additional FTB Part A will be paid as an initial payment of $500, with the remainder to be paid in seven fortnightly instalments.

The Baby Bonus currently cuts out at an earnings threshold of $150,000, but the earnings cut-off for FTB Part A is $94,316 so the Government’s move effectively limits a high proportion of top earners’ access to the financial assistance for newborns. Families accessing the Government’s Paid Parental Leave (PPL) scheme, which remains unchanged, will not be eligible for the additional FTB Part A component. However, the work test under the PPL scheme will be extended so that parents will be able to count periods of Government PPL as “work”, just like employer-funded PPL.